By Ikenga Ezenwegbu

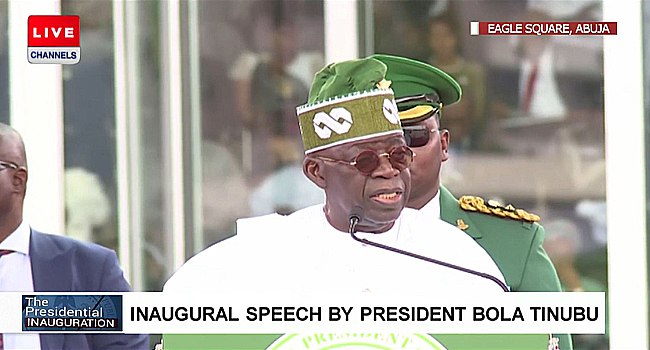

In his inaugural speech, President Bola Tinubu promised to introduce a unified foreign exchange rate system in Nigeria. What he simply means is that the Central Bank of Nigeria, banks and any entity that earns dollars in Nigeria shall be made to sell and buy US dollar at a uniform exchange rate. There will be one buying rate and one selling rate across Nigeria.

The implication is that the same exchange rate shall be used to calculate import duties as per forms M, settle letters of credit, and all forms of foreign remittances. Same shall apply to personal or business travel allowances and activities at the BDCs.

Also, the unified rates will be known to exporters or capital importers sell their FX earnings to get naira for their local operations.

Tinubu Ends Fuel Subsidy, Vows To Review Multiple Taxation

Please note that Nigera’s FX transactions are primarily traded in US dollars which could be converted to other world currencies known as 3rd currencies in banking parlance.

It is important to also note that these proposed unified rates will not be static as they will keep changing like Port Harcourt weather. That is, the exchange rates in the morning might differ from that in the afternoon or evening. They will be going up and down like pendulum in response to market dynamics.

Most importantly, CBN will be required to fix the difference between the buying rate and selling rate and anyone that trades outside of the band could be punished if caught.

Why the Unified Exchange Rate Might Not Kick Off So Soon

I believe that our president’s pronouncement was well intentioned and has been suggested by foreign trained economists but when he settles down, the economists that have their hands on the saddle will brief him on other issues and sensitive information not usually and not readily available to politicians and public affairs commentators. Some of the issues include:

JUST IN: Tinubu Sworn In As Nigeria’s 7th Democratically Elected President

1. Negative Balance of Trade: This is a situation whereby a country’s import is more than its export hence foisting on it a situation whereby the country has to wisely allocate available FX to critical areas of the economy that drive growth, employment and tax incomes. Many commentators have argued that this process had been abused.

2. Demand Pull Devaluation: the basic principle of unified exchange rates is near sufficiency of FX through exports so as to mitigate the massive devaluation caused by high and sustained demands for FX by importers knowing full well that Nigerians love imported items including medicare.

When equal access is created for FX, traders and merchants of all kinds will outsmart manufacturers in getting all FX hence further destroying the economy. No government would love to tolerate this.

I guess that the unified FX policy would make sense in August 2023 when Dangote refinery removes our large FX spending on imported fuel and also earns more FX for the country from exporting excess fuel and allied products. Expected abatement of insecurity across the country will also help reduce food importation hence enhancing Nigeria’s FX balances.

Bola Tinubu: Aisha Yesufu Declares Peter Obi Her President

There are other issues that border on national security or political economy I will not discuss here.

To be continued…

Follow us on Facebook

Post Disclaimer

The opinions, beliefs and viewpoints expressed by the author and forum participants on this website do not necessarily reflect the opinions, beliefs and viewpoints of Anaedo Online or official policies of the Anaedo Online.